The whole idea is that each of these values starts with a certain number of zero bits.

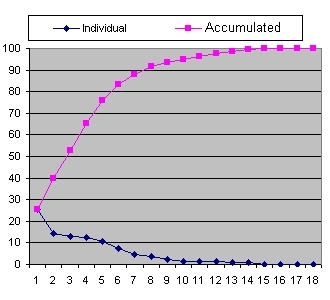

- At position 1 (bit 1) of all the values 50% will have a one and 50% will have a zero.

- Out of these last values at position bit 2: 50% will have a 1 and 50% will have a zero. That means 25% will start with two zero bits

- Out of these last values at position bit 3: 50% will have a 1 and 50% will have a zero. That means 12.5% (or each 8 operations) will start with three zero bits

In 6.25% (or each 16 calculations) you get 4 zero bits and in 3.125% (or each 32 calculations) you get 5 zero bits.

The following table shows the result of a simulation based on 664 calculations.

bits hex limit # calc expect deviation 1 01 4 0,5 2,05 1,02 1,38 2 001 2 0,25 3,94 0,98 3,19 3 0001 1 0,125 7,28 0,91 6,39 4 00001 08 0,0625 15,73 0,98 15,59 5 000001 04 0,03125 31,84 0.99 32,27 6 0000001 02 0,015625 65,80 1,03 68,19 7 00000001 01 0,0078125 138,04 1,08 134,06 8 000000001 008 0,00390625 275,20 1,07 272,60 9 0000000001 004 0,001953125 544,09 1,06 530,72 10 00000000001 002 0,000976563 1034,60 1,01 952,78 11 000000000001 001 0,000488281 2032,00 0,99 1902,55 12 0000000000001 0008 0,000244141 4025,24 0,98 3792,76 |

For the low number the same logic applies. A low number always starts with a zero bit. A lower number with two zero bits and an even lower number with three zero bits i.e. 000

You can also express each number as a fraction between 0 and 1. That means any number that starts with a one has a value equal or higher than 0.5. Any value that starts with one zero has a value lower than 0.5 Any value that starts with two zero's has a value lower than 0.25 Any number with starts with three zero's has a value lower than 0.125 etc

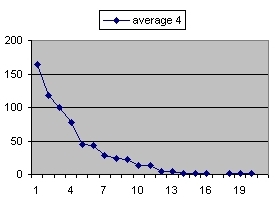

Each line shows the results of the simulations how many calculations (on average) are needed to calculate a value that is smaller than a certain limit. This limit is shown in column 3 and the # of calculations in column 4

- The first line shows that on average 2,05 calculations are needed to get a value that is lower than 0.5

The theoretical value is 2. When you divide 2,05 by 2 you get 1.03 This number in column 6 indicates that the number of calculations performed is slightly more as predicted. - The second line shows that on average 3,95 calculations to get a value that is lower than 0,25. The theoretical value is 4

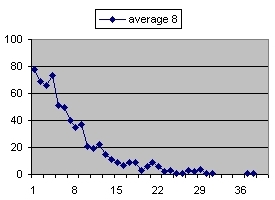

- The fourth line shows that on average 15,78 calculations to get a value that is lower than 0,0625. The theoretical value is 16 Line 4 also shows that the limit value in hexadecimal notation is "08". This is the number in column 4.

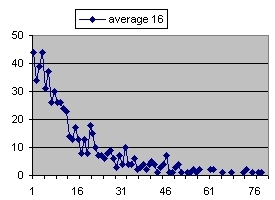

What this means that on average to get a value that starts with a zero in hexadecimal notation you need 16 calculations. - Line 8 shows that on average 274,25 calculations to get a value that is lower than 0,0039. The theoretical value is 256 or 2^8.Line 8 also shows that the limit value in hexadecimal notation is "008".

What this means that on average to get a value that starts with two zero's in hexadecimal notation you need 256 calculations.

|

|

|